Manufacturing: A Detailed Industry Insight

STEEL INDUSTRY:

Overview

This market research report includes a detailed segmentation of the steel industry by type (carbon steel, alloy steel, and stainless steel) and by-end users (infrastructure and construction, mechanical machinery, and automotive industry). It outlines the market shares for key regions such as the Americas, Asia Pacific(APAC countries), Eastern Europe, Middle east & Africa or EMEA.

![]()

TechNavio’s market analysts predict that the global steel industry is to grow steadily at a CAGR of around 2%, in terms of consumption volume in the period between 2015-19. The growth of end-user industries such as automotive, mechanical machinery, and infrastructure and construction is driving the demand for steel. The infrastructure and construction sector, which accounts for more than 52% of the world’s steel consumption, is expected to grow at a rate of around 8% by the end of 2020.

The rapid growth of developing economies such as India is also expected to contribute to the market growth during the forecast period(2015-19). Around 63% of the demand in India is catered by the coal-intensive blast furnaces. The Indian government has banned iron ore, to fight against illegal mining; this move is expected to reduce the domestic supply. Steel industry and its associated mining and metallurgy sectors have seen a number of major investments and developments in the recent past. According to the data released by Department of Industrial Policy and Promotion (DIPP), the Indian metallurgical industries attracted Foreign Direct Investments (FDI) to the tune of US$ 10.33 billion in the period between April 2000–March 2017. The Government has also taken many initiatives in this regard, the Union Cabinet, has approved the National Steel Policy (NSP) 2017, as it seeks to create a globally competitive steel industry in India. NSP 2017 targets 300 million tonnes of steel-making and 160 kgs per capita steel consumption by 2030. The Ministry of Steel is facilitating setting up of an industry driven Steel Research and Technology Mission of India (SRTMI) in association with the public and private sector steel companies to initiate research and development activities in the iron and steel industry at an initial corpus of Rs 200 crore (US$ 30 million)

Chinese Economic Slowdown: The economic rebalancing and reform agenda of the Chinese economy continued for the first half of 2016; This got interrupted when the government spearheaded mini stimulus measures to counter growth headwinds. The measures aim to support the agricultural sector, boost investment in public facilities and improve environmental protection. This produced a short term boom in infrastructure investment and the housing market, which stimulated demand for steel and other commodities. As a result, China’s steel demand showed growth of 1.3% in 2016. While the Chinese economic outlook appears stable and steel demand continues to remain strong in the early part of 2017, this is expected to gradually decelerate as the government tries to re-tighten its real estate policies.

Watch this impelling informative documentary on China’s economic collapse:

China’s steel demand is expected to remain flat in 2017 and then decline by -2% in 2018. Steel demand in the emerging and developing economies excluding China, which accounts for 30% of world total, is expected to grow by 4.0% in 2017 and then 4.9% in 2018.

Global economy is gaining strength, but uncertainty escalates

Having dealt with the structural problems and fall in commodity prices, the Russian and Brazilian economies are stabilising and expected to show modest growth on June 21, 2017. Russian growth will continue to pick up in 2018 as structural reforms take more effect. Russian President Vladimir Putin met with his Brazilian counterpart Michel Temer in Moscow, 2017, to discuss future economic and bilateral cooperation.

Take a look at the conference:

With the risk of global recession abating and economic performance improving across most regions, a number of geopolitical changes still create some concern. US policy uncertainties, Brexit, the rising populist wave in current European elections and the potential retreat from globalisation and free trade under the pressure of rising nationalism adds a new dimension of uncertainty in investment environments. To balance this, risks from ongoing conflicts in the Middle East and in Eastern Ukraine appear to be reducing.

![]()

The construction and infrastructure sector accounts for 50% of global steel use. This sector has been showing a divided picture between the developing and developed economies, whereas it has been a major boost for steel demand in the developing countries. But activity in the developed economies since the 2008 financial crisis has been more subdued. This appears to be changing with a recovery in construction activities apparent in the EU through the improving economic conditions and the potential renewal initiatives for infrastructure in the US.

The machinery sector could also benefit from rising investment activities if the uncertainties surrounding the global economy can be contained. On the other hand, depression in shipbuilding activities is expected to continue for some time given the global glut in shipping capacity.

![]()

Benefiting from strong fundamentals, newly announced measures related to fiscal stimuli and rising infrastructure spending, the United States is expected to continue to lead growth in the developed world in 2017-18. Eurozone monetary policy is expected to remain on its current path, at least in 2017, while fiscal tightening is not expected to tighten further and risk of disinflation has significantly gone down. If political stability can be maintained, investment is expected to pick up to provide a further boost to the recovery.

Some of the most exemplary strategic marketing and promotional inspiration can be amassed by following the layouts of the legendary Tata Steel.

Website

The first tick in the box for every business should be a brilliant website. Brands that have a consistent visual language make a more memorable impression than those that look like five different side-businesses. If we take a look at Tata Steel’s immaculate website, we will know what it takes to have a business that is impactful and larger than life. http://www.tatasteel.com/#spotlight

Social media activities

![]()

Generate higher converting leads with Social media marketing:

Social media increases sales and customer retention through regular interaction and timely customer service. In the 2015 Sales Best Practices Study from research institute MHI Global, world-class companies rated social media as the most effective way to identify key decision makers and new business opportunities. In the State of Social Selling in 2015, nearly 75 percent of companies that engaged in selling on social media reported an increase in sales in 12 months. An Iron & Steel Industry like Tata has made the stand and showcased their social activities in their social media accounts like Facebook, Twitter et al and is updated meticulously. They run several campaigns like the “Young Astronomer Talent Search” to garner positive interaction and motivation of the masses.

Promotional Videos:

Sales video is starting to become the primary essential tool of marketing strategy. It’s efficient, fast and engaging compared to an article that is sometimes boring and non-informative. Different industry is now utilising the power of corporate video production to boost their sales, presence and credibility. It also serves as an ideal way to get in touch with their customer especially in the industry of real estate. Based on the statistics released by NAR (National Association of Realtors), at least, 90% of the parties that are interested to purchase anything new, they use the internet as their primary source of knowledge. 85% of those buyers found photos and animated video explainer to be an important part of their decision-making. Tata Steel mesmerizes the world with their thrilling and dynamic videos: not only are they compelling, promotive but also highly informative. Let’s take a look at few of them:

Apps

Everybody knows the importance of going directly to where your customers are and although the app revolution only started a few years ago, this form of marketing is growing fast with no signs of slowing down. Currently 77% of the world’s population are online. With the rapid adoption of smartphones and tablets businesses are faced with more and more opportunities every day that will radically change how their service or product is delivered and accessed.

Every major business or industry today procure an app for connectivity. Take a look at this one: https://play.google.com/store/apps/details?id=com.tatasteel.ir&hl=en

AUTOMOTIVE INDUSTRY:

Many businesses involve complicated technical procedures which can be intimidating if not explained properly to your customers or potential customers. Videos can be the best way out for this: moving images, music and symmetry is not only appealing but can be the best and easiest way of remembrance; rather than reading out something complicated, your customers will definitely prefer a well-explained, concise video: Most explainer videos also conclude with a call to action that prompts viewers to associate with the brand. You can take inspiration from Tesla Car videos: Watch Tesla owners as they charge their way across Europe

Website

A simple question, What is a website? In its bare form, a website is a single domain that consists of different web pages. We should all know that by now, but surprisingly what we don’t all know, is the benefits a website can provide for your business and its shocking to witness how many business don’t actually have a website or online presence! If you have a business and don’t have a website, you are losing out on great opportunities for your business. A website itself can be used to accomplish many different marketing strategies to help your business grow. As a business owner, you need to know where your consumers are. But what if consumers know your business and what you can offer, but they can’t reach you? That is one of the risks you take by not having a website for your business. Let us take a look at the website of the very famous Tesla cars and see how potent and crucial a website is and should be for a formidable business: they ‘move’ like their cars with the help of website sliders: https://www.tesla.com/

Apps

In an era where the whole world is in one’s hand, you should to be there for your customer just a swipe away. The popularity for smartphones have a lot to do with the availability of apps. And almost 44% of the world population owns a smartphone today. The striking advantage of apps is their versatility. You can use it for a wide variety of purposes. If each of them is unique in its features, you can launch multiple apps and each app will add to the likeability of your brand. You cannot have multiple websites for your firm but you can absolutely afford apps!

![]()

The Tesla app puts owners in direct communication with their vehicles and Powerwalls anytime, anywhere. With this app, you can:

– Check charging progress in real time and start or stop charging

– Heat or cool your car before driving – even if it’s in a garage

– Lock or unlock from afar

– Locate your vehicle with directions or track its movement

– Flash lights or honk the horn to find your vehicle when parked

– Vent or close the panoramic roof

– Summon your vehicle out of your garage or a tight parking space (for vehicles with Autopilot)

– Engage with Powerwall: monitor how much energy is stored from solar, used by your home, or exported to the grid

Before we start with the automotive industry, let us take you through the entire evolution of the automobile industry; it is comprehensive, detailed and thorough- a good watch, before a good read:

Outwardly the global auto industry, performance is strong, but more challenged than is evident. Worldwide sales reached a record 88 million autos in 2016, 4.8% up from 2015, and profit margins for suppliers and automakers (also known as original equipment manufacturers, or OEMs) are at a 10-year high. Nonetheless, viewed through the lens of two critical performance indicators, the industry is in serious trouble.

![]()

First, total shareholder return (TSR): Over the last five years, the annual rates of return that the S&P 500 Index (an American stock market index) and DJI Average achieved for investors (including dividends) were 14.8 % and 10.1%, respectively. In that period, average auto maker TSR was only 5.5 percent.

Second, return on invested capital (ROIC): In 2016, the top 10 OEMs returned only 4 percent, about half of the industry’s cost of capital. The leading 100 suppliers have done a little better, just beating their costs of capital to enjoy a small positive return, after many years of negative net returns.

These numbers almost outweigh the positive sales and earnings results. They paint a picture of a sector that is a less lucrative place to invest than other industries. This assessment suggests that there will be relatively few winners in the auto industry during the next five years and beyond. Those that do stand out will be the companies that harness their limited capital resources in creative ways, to navigate a still-unfolding and unfamiliar landscape.

![]()

To be sure, rates of return on capital have been a problem prevalent to the auto industry for years, which is one reason for the many bankruptcies —among OEMs and suppliers, particularly in the past decade or so. Surviving automotive companies have famously bent over to save pennies on every car or component they make. However, the situation is becoming more dire; The cost of capital is unlikely to come down from its already low inflation-adjusted levels, and new capital outlays are rising for advances in autonomous driving technology.

![]()

Indeed, what is particularly notable about the current wave of innovation in automobiles is not so much the speed with which it has emerged, as the breadth of the innovation — but how much it is altering the basic contours and features of the traditional automobile and amplifying the difficulty and cost of manufacturing cars. Ubiquitous electronics, a variety of digital services, and novel powertrains and connectivity systems are hastening the need for expensive new parts, components, and functions. For OEMs, the price tag is high — as much as 20 percent greater than the cost of the previous generation of automobiles.

![]()

![]()

New technologies such as 3D laminated glass, haptic sensors, and augmented reality heads-up displays — which offer drivers alerts, safety aids, and warnings on invisible screens embedded in the windshield — have entered the vocabulary of traditional suppliers. Large navigation and entertainment display screens in the dashboard offer web-based information and media. The autonomous car will further up the ladder, and soon it will change the “living space” dimension of automotive interiors. The front seat may be reoriented to face the back seat, so passengers can converse as they would in their living rooms while the car cruises to a destination. Or seats could face a windshield that’s become a large movie screen. Little wonder, then, that vehicle electronics could account for up to 20% of a car’s value in the next two years, from what it used to be-only about 13% in 2015.

![]()

Innovative software developments may make tomorrow’s vehicles exceptionally expensive: OEMs and suppliers must earmark resources for acquiring new technology. Many of the new features going into cars require the expertise of software engineers. Taken as a whole, innovation-related challenges are reshaping traditional auto industry structures and relationships, by threatening the existing distribution of profits and the boundaries between OEMs and Tier One or Tier Two suppliers. Some suppliers will fold, as their business goes away completely, and others will struggle because changes in technology content will bring OEMs or non-automotive suppliers into their markets as new competitors. Decisions about investments and industry alliances that are being made now will determine the dominant positions of tomorrow. The solution will likely come from a combination of actions. Part of the answer lies in consolidation, which reduces industry capital requirements by eliminating competition and combining two manufacturing and design footprints into one.

OEMs should consider three actions:

Share platforms and manufacturing– Platform sharing among OEMs is rare. In the U.S., GM and Ford are jointly designing a new 10-speed transmission. In both cases, the companies expect cost savings, particularly in R&D and materials procurement. If automakers expanded their cooperative efforts, the industry would essentially be smart-sizing. Similarly, we have seen rebadging across brands in markets where sales volume is low. For instance, Renault, Nissan, and GM have been cooperating in manufacturing some light commercial vehicles, virtually identical products sold under three different brands.

Redesign distribution models- Upward of 15 percent of a car’s cost typically goes to distribution. In the U.S and Europe, OEMs are engaged with dealer relationships by complex and outdated rules. They should begin to aim for approaches that will reduce costs by using more efficient channels to reach car buyers.

Conclusion-

These changes in the distribution system should ultimately aim to cut costs by minimizing the number and expense of retail outlets and using technology for better inventory control.

Savings could come from selling via web channels. In the U.S., OEMs are barred from bypassing dealerships, a prohibition that electric carmaker Tesla is campaigning to eliminate. Rather than opposing Tesla, as some automakers have, U.S. OEMs should view this potential change as an opportunity to innovate. In short, suppliers must recognize the world they inhabit and make sure that they can effectively navigate it.

TEXTILE INDUSTRY:

The textile and apparel industry has witnessed changes in the last few decades. Over the years, a major part of the industry has shifted from developed countries like the US, the EU and Japan to destinations like China, South Asia and South-East Asia. Two most vital variables which brought on this move were the availability of low-cost manpower and abundance of raw material in Asian countries. India is one of the most competitive textile and apparel manufacturing centre today.

![]()

Image source: https://blogcdn.stepchange-innovations.com/wp-content/uploads/2015/04/Share-global-trade-textiles.jpg?9b07e2

Today’s textile and apparel sector is again at the brink of major structural changes. The demand pattern is governed by economic growth of regions, which indicates a slowdown in developed countries while strong growth in China and India. The export growth rate of China has already slowed down, something that will lead China to lose some share of global market while still being the largest exporting nation. The opportunity arising because of China’s export growth slowdown can help countries like India, Bangladesh, Vietnam, etc., to increase their trade share.

FTAs of these suppliers with major markets of EU, the US and Japan will be of special importance. On the supply side, lack of growth in cotton output will help synthetics to gain share continually. These are some of the megatrends that will impact the industry structure over the next decade.

For the Indian industry, these are specifically interesting times. India stands a chance to gain a prominent market share because of China’s growth slowdown, supporting the Government policies and a strong raw material base. The way that India’s own local request is likewise vast and developing is strong enough to beat down every competitor.

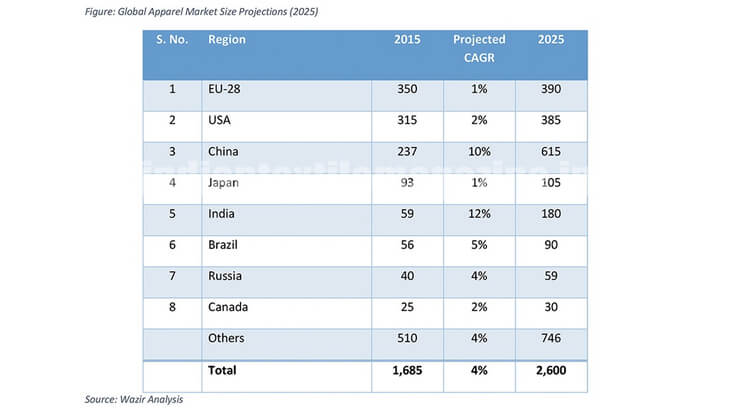

The current global apparel market is estimated at $1.7 trillion which forms approximately 2 % of the world GDP of $73.5 trillion. Apparel consumption in top 8 economies constitutes approximately 70 per cent of the global consumption. All four BRIC nations appear among the top markets having a cumulative share of approximately 23%. Combined apparel consumption of the US and the EU is 40 per cent while they are a home to just 11 per cent of the world population, implying a very high level of per capita expenditure on Apparel (PEAP) compared to the rest of the world.

Image source: http://www.indiantextilemagazine.in/wp-content/uploads/2017/02/Textile-Article-Graph-1.jpg

An increase in the disposable income of the developing countries would mean that for an emerging or developing market the apparel consumption growth rate would be faster than its economic growth. Based on the projected GDP growth rate and its relation with the apparel market growth, it is projected that the global apparel consumption will increase to $2.6 trillion by 2025.

Marketing and Promotional strategies:

The most effective marketing strategies combine traditional marketing tactics with creative platforms to reach your audience. Today, the fashion industry has almost unlimited resources at its disposal. A big part of the online community includes blogs, bloggers and social networks. In many instances, bloggers are tweeting or writing elaborately about the products and ideas they discuss on their blogs.

Corporate videos is also a very crucial and effective marketing strategy. A corporate video has an array of benefits. When you are looking for a professional way to present yourself to the wider community and to potential buyers/clients, you need a way to talk about what you do and “show” people. Throughout marketing books, you will find people talking about the importance of showing instead of telling.

Regardless of how good of a storyteller you are, it comes down to being able to show people what it is you can give them that they want. You cannot properly show without using video. A corporate video provides both visual audible stimulation which means it’s very effective.

If a photo is worth 1,000 words, imagine how much a video is worth. Whether people click on a link from your company newsletter or are met with the video upon arriving to your homepage, it needs to be done in such a way that it captivates them. You want people to stay glued to the screen from start to finish so that they learn about you and what you have to offer. Let’s take a look at some of the best corporate videos in the fashion industry by Chanel:

Virtual reality environment for the fashion industry is on the rise. It is not just the latest of all technological evolution but also, will drive the industry according to the needs of the present century and future buyers. Let’s take a look at what VR experience for fashion retailers can mean:

China and India have successfully leveraged their large human resource base, low manufacturing costs and large scale infrastructure to achieve a leading position in the world trade. While China has been at the forefront of attracting investments, India replaced China as the largest FDI recipient in 2015. Despite global uncertainties, the Chinese market grew at 15 % annually while the Indian market grew at 11% from 2007-15. Apart from economic growth, India’s market expansion is expected to be supported by increasing youth population and high purchasing power, shift from need-based purchase to aspiration-based purchase, urbanization and growth of new retail formats with better reach. For China, the specific demand for kids wear is expected to rise with the abolition of one-child policy. Similarly, demand of outdoor wear and fast fashion categories is increasing rapidly. There is also gradual increase in spending of the Chinese customer from the offline to online retail channel.

![]()

Consumption of man-made fibers will grow globally

In 2015, the global fibre consumption was around 90 million tons, of which polyester and cotton had a share of 51 per cent and 31 per cent, respectively. Rest 18 per cent was contributed by other fibers. Cotton has always been and will continue to be a crucial raw material to the textile industry, but due to increased supply demand, it may struggle to satisfy growing demand in future. It is expected to stagnate around the current level of 26 million tons over the next few years. On the other hand, the global fibre demand is continuously growing. It is expected to grow at a CAGR of 2.5 per cent and reach 115 million tons by 2025. This supply-demand mismatch will lead to an increase in consumption of polyester fibre and to some extent cotton-like fibre like, viscose.

![]()

Changes in consumer lifestyle, like increasing emphasis on fitness, rising brand consciousness, fast-changing fashion trends, increasing women participation in the workforce and hygiene consciousness are driving the trends in the end products. Impact of such trends is passed along the textile value chain which in turn has resulted in high demand of the fibres that can fulfill these requirements at the affordable price. In this context, polyester has proved to be the most cost-effective and adaptable fibre.

Wide acceptance of Man-made Fibre(MMF) in end-use categories like sportswear, leisurewear, women’s dresses, home textile, carpets and other industrial sectors has increased the market demand of manmade fibers. As a result, the share of cotton will continue to decline from 31 percent in 2015 to 28 percent in 2025. During the same period, the share of polyester will grow from 51% to 55% implying that by 2025 global consumption of polyester will be almost double than that of the cotton fibre.

Conclusion

Manufacturers have to confront four major challenges:

-

- Buyers command a strong control over manufacturing value chain

-

- Low entry barriers lead to intense competition from unorganized players

-

- National as well as bilateral/international policies have the potential to make or break an entire business model

- Maximum trade is concentrated in price-sensitive commodity business lacking product differentiation

In such a scenario, attaining manufacturing excellence becomes a function of five factors – productivity enhancement, market intelligence, sustainable manufacturing, product and design development and international partnerships.

FURNITURE INDUSTRY:

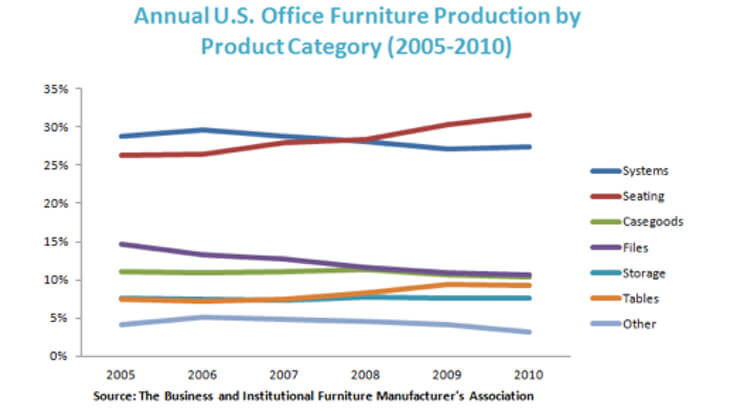

During the economic recession, the furniture retail industry was negatively impacted as consumers cut back on non-essential spending, but now there is an uptick in demand. In fact, the U.S. furniture industry has outpaced the U.S. economy in recent years. While the housing market improves and discretionary spending increases, we will see this growth continue. By 2019, the global market for furniture and floor coverings is forecast to reach $695 billion.

![]()

Image source: https://image.slidesharecdn.com/furnitureindustryvietnamsummaryglobalmarketoutlook-130402095853-phpapp02/95/furniture-industry-vietnam-summary-global-market-outlook-11-638.jpg?cb=1364896788

Several key industry trends have emerged, as new innovation and shifting consumer preferences influence the demand for furniture.

- The rise of telecommuting is driving the demand for home office furniture

The need for home offices increased during the financial crisis in 2008-2009 and the European debt crisis in 2011-2012, driving increased demand for computers, desks, office chairs, and filing cabinets. Consumers quickly found that their home offices had multiple uses, and they often preferred to buy versatile furniture that could cover up office equipment when not in use. As a whole, the market for global home office furniture is forecast to grow at a compound annual growth rate (CAGR) of 5.58 percent between 2014-2019.

Consumers quickly found that their home offices had multiple uses, and they often preferred to buy versatile furniture that could cover up office equipment when not in use. As a whole, the market for global home office furniture is forecast to grow at a compound annual growth rate (CAGR) of 5.58 percent between 2014-2019. - Multi-functional, versatile furniture is gaining popularity

The number of single- and two-person households has been increasing, resulting in the demand for small and portable furniture. Watch this video that verily captures ‘why’ multi-functional smart furniture which is the major buzz now!

Consumers have also been looking for furniture that is multi-purpose, foldable, and technology-driven, especially when it comes to living in smaller spaces.

IKEA has been the world’s largest furniture retailer since 2008 incorporating ‘Small spaces: Small ideas’- - Online is the fastest-growing channel in developing markets

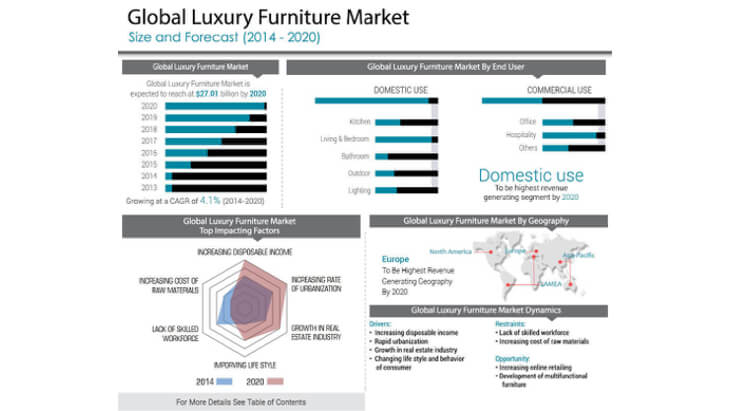

The U.S. home furnishings store industry includes about 15,000 stores with combined annual revenue of about $27 billion. The industry is extremely concentrated, with 50 of the largest U.S. stores accounting for 75 percent of the industry revenue. But, the competition is rising. Online stores are becoming the fastest-growing channel at a CAGR of 16.6 percent. Many companies are putting more efforts towards their online retail stores, by adding benefits for consumers who shop online such as free delivery and installation and even same-day pick up. - The demand for luxury furniture is increasing

As the economy has grown, more consumers are willing to buy luxury items for their living and work environments. In terms of location, Europe has the largest market for luxury furniture, but developing countries such as China and India are not far behind. Luxury Furniture Market is expected to garner $27.01 billion by 2020, registering a CAGR of 4.1% during the forecast period 2015-2020. Major factors owing to progress in this sector include rise in disposable income that leads to rise in demand for luxury living thus influencing sector growth.

To go global, many furniture designers are always on the lookout for international styles. Luxury furniture, consignment scene has also expanded with furniture designers and manufacturers going online. This has helped many furniture label to focus on the high end segment, and lure extremely strong clientele in the luxury home and office furniture market. Companies born to serve the made to order requirements are now opening their stores in different geographical locations to provide buyers creative designs that go well with time. Besides this, many furniture manufacturers are partnering up with artists or interior designers to create and offer a luxury range. Time and now furniture manufacturers are seen giving their concepts an update to provide home and office owners fresh choices. - More furniture vendors are choosing to go greenWith luxury comes the expanding trend to go green. Many vendors are developing eco-friendly furniture. This trend is driven by environmental concerns, such as the problem of deforestation. Although eco-friendly furniture is more expensive, the demand is on the rise, making it worthwhile for manufacturers and companies to offer these products. Circle Furniture had started out with bringing eco-friendly and green furniture; watch their immaculate corporate video to learn more about the trend, market demand and growth possibilities:

Marketing and Promotional strategies:

The most important tick in the box for any furniture company should be going on the web. What retailers sell offline, should imperatively come online. The most popular and thriving company in this industry in India today is Urban Ladder. Their website has covered all dimensions of home essentials. When customers come to buy furniture, they would be extra glad to see that one location has burgeoned to myriad dimensions and fulfill all home essentials required.

In the arena of Furniture, Pinterest is the greatest viable social photo sharing portal, allows users to create theme-based image collections on a virtual pinboard. This can be a great way to effectively display your furniture collections.

![]()

All the popular furniture retailers are now making use of apps and videos to reach out to millions of people who are ‘online’ and are potential buyers. Videos are necessary for this industry as it will be more like storytelling. To be able to “see” things, woven around a story is crucial where buyers can visualize items and feel like getting a shopping experience even before visiting a physical store. Let us watch some of the most viewed and beautiful videos of the industry and why they are ‘needed’. –

When people buy furniture, they first try to visualize their home and how it’ll be looking after the purchase in that specific home backdrop. For that virtual reality, apps are booming the business front for furniture. Virtual reality apps let customers pick up their choice of furnitures or flooring giving them the choice to put in their ideal spots. Herein, the customers get maximum satisfaction as they can see real-time changes virtually without even visiting a store and shop virtually what they like at their own convenience.

Let’s take a sneak peek at VR furniture apps and why they are viable-

ELECTRONICS INDUSTRY:

Output for the global electronics industry is forecast to reach US$1,861 billion in 2015 and compares to US$1,047 billion thirty years earlier. Over the period, the dynamics of the industry has changed. Production has migrated from high cost to low-cost locations and China has emerged as the focal point for electronics equipment production for high volume products in the computing, consumer, and communications, or the 3C segment of the market.

![]()

Image source: http://economists-pick-research.hktdc.com/resources/MI_Portal/Article/ef/2011/05/347031/1304560826269_eGraph1_347031.jpg

Despite the migration of production to lower cost facilities, a significant proportion of equipment production, where the focus is on lower volume higher mix products, has remained in Western Europe and the US. These sectors, primarily in the industrial, medical and communications (including defence) sectors of the market will continue to offer significant opportunities for a wide range of companies. Both regions will also benefit from their leading position in research, design, and development. The requirement for lower cost manufacturing within close proximity of the end market has benefited both Mexico and Central and Eastern Europe.

Initially, the focus for higher volume manufacturing and the pressure to reduce costs has seen an increase in the production of more complex products, a trend which will accelerate over the next five years. In Asia, China itself is coming under increasing pressure as the major global OEMs and Electronics Manufacturing Services (EMS) providers look to relocate production to offset higher costs. India and Indonesia, with large domestic markets and the recent move by their respective governments to introduce requirements for “local” manufacture, and the benefits of lower costs in Vietnam, will be attractive alternatives to manufacturing in China.

![]()

Mirroring the transition in production, the focus for the global electronics market is also towards the emerging countries, not only for products in the volume segments of the computing, consumer and communication markets but also in areas such as medical, control and instrumentation, defence and industrial. The electronics industry is a global one but to fully understand it, you need to be aware of developments not only globally but also regionally and at a country level. The Global Electronics Database, which draws on over 40 years of research, enables you to achieve this both cost-effectively and in a format where you can analyze the data for your own specific needs.

Major factors for 2017 component predictions

However, there are many uncharted factors that could affect the economic conditions that govern the overall global economy.

Brexit or British Exit – With the UK planning to leave the European Union, the conditions under which this will happen still needs to be negotiated, and the outcome could have a significant effect on many sectors of the global economy.

European Elections – following on from Brexit, it is quite likely that other countries could meet with the pressure of leaving EU. In addition to this, there is a possibility that many governments could change. There also seems to be a movement whereby totally new governments come to power that has untried policies. This places a major uncertainty into the future.

European Economies – in recent years with countries like Greece requiring enormous bailouts there has been considerable unease in the financial markets about the future. With Italy now looking a little less stable this could have a major effect on global confidence and business which will impact the electronics manufacturing industry.

World recovery – after the major downturn of 2008, many economies have been very slow to recover. In fact, the latest statement from the International Monetary Fund states that global growth is projected to remain modest at 3.1% in 2016 and that there has been an impact caused by the uncertainty of Brexit. Then for 2017, it states that recovery is expected to gather some pace in 2017 as conditions in some economies normalize.

![]()

Electronics usage for the 2017 component predictions

When looking at the global electronics component predictions, it is necessary to look at the areas in which electronic components are used these days. There are many traditional areas such as general industrial electronics, domestic electronics, mobile telecommunications, fixed-line telecommunications and the like. Many of these areas are remaining steady, but the one that is seeing a considerable level of growth recently is the automotive industry. The level of electronics that is being incorporated into automobiles these days has increased considerably. The level of autonomous control is set to dramatically rise, and this too, will increase the level of electronics in the standard car. This will boost the electronics industry as a whole and also the electronics component requirements.

Another major driver is the ‘Internet of Things’. With automated homes, factories and cities becoming a reality, the level of electronic control, and the need for modules is increasing even now and will continue to do so markedly, fuelling the growth in the use of electronics and the demand for components.

Marketing and Promotional layouts

When it comes to your social media marketing plan, there’s no point in reinventing the wheel. Instead, take advice from businesses that have found success when using social. All successful businesses have grown to know their audiences very well. The benefit of social media is that, getting to know your audience is now easier than ever. With analytics like Facebook Insights in HootSuite, you can understand the major demographics and patterns of your customer behaviors. This not only allows you to better target your audience but it also helps you understand the specific needs of your customer base.

The most innovative, impactful campaigns and promotional layouts of the electronic industry are run by mobile phone industry and car companies. Let’s go through some promotional strategies that are followed by the ineffably famous Redmi phones.

Facebook Pages: A Facebook page has many potential benefits for your business. While some of these benefits are similar to having a website, a number are unique to Facebook. Such as, Facebook is a low-cost marketing strategy and has millions of users. Not having a Facebook page for your present-day business can be a major glitch. Redmi has their own Facebook Business page to address their customers about products and campaigns. They have around 8 million likes on their Facebook page.

![]()

Videos: All these successful business companies have indiscriminately produced videos for promotion and creating a buzz among people. Mobile users and avid mobile buyers should be given a gist of what makes every model unique and different and ‘why’ exactly one company should be preferred more than another. Let’s take a look at the promotional and explainer commercial videos and ads watched worldwide.

Redmi also has a wide base on Instagram with their profile miindiaofficial and has garnered more than 1M followers.

![]()

Outlook summary

There appears to be an underlying confidence in the market, although there is not any expectation of high growth. The growing markets like automotive and IoT are already seeing growth and many expect these to be major factors that fuel the growth in 2017 and beyond. It is expected that design activity will remain strong and that this will ensure new products enter the market in the coming years. That said growth will not be enormous. The overall economic growth of around 3.1% will be matched by a similar figure for the electronics industry.

As such, the outlook looks steady for the future. The economic meltdown of 2008 is still having its effect, but the positive shoots or automotive and IoT are now growing well and should bolster other areas like telecommunications as well as the many other areas of industrial and domestic electronics.

This was an overview and analysis of the growth and marketing techniques in the Manufacturing Industry. If you would like to have a detailed discussion, please get in touch with us at hello@pixelsutra.com. We would be glad to assist you.